- 70240 Avenue of the Moon, California

- +4733378901

Ideal for companies involved in trading goods or commodities. It permits businesses to conduct import, export, and distribution activities within the UAE Free Zones and international markets.

Suitable for businesses offering specialized services, including consultancy, IT, media, and marketing. This license allows companies to operate within the Freezone, offering skill-based services locally and globally.

Designed for manufacturing, processing, and assembly of goods. It’s ideal for businesses looking to establish production units or factories within Freezones, especially those that need low overheads with quality facilities.

Suitable for online businesses that wish to operate within and beyond the UAE, providing a gateway to international e-commerce markets with minimal logistical constraints.

For a single shareholder, an FZE is an ideal structure offering limited liability and full control. It’s meant for entrepreneurs and solo investors looking to fully own their ventures.

An FZC allows businesses of 2 to 5 shareholders, making it ideal for partnerships or multi-investor ventures. It provides limited liability with flexibility in permissible activities.

This business structure allows foreign investors to set up and operate their branch within a Freezone. The branch works under the name of the parent company, giving access to local markets without needing a separate legal entity setup.

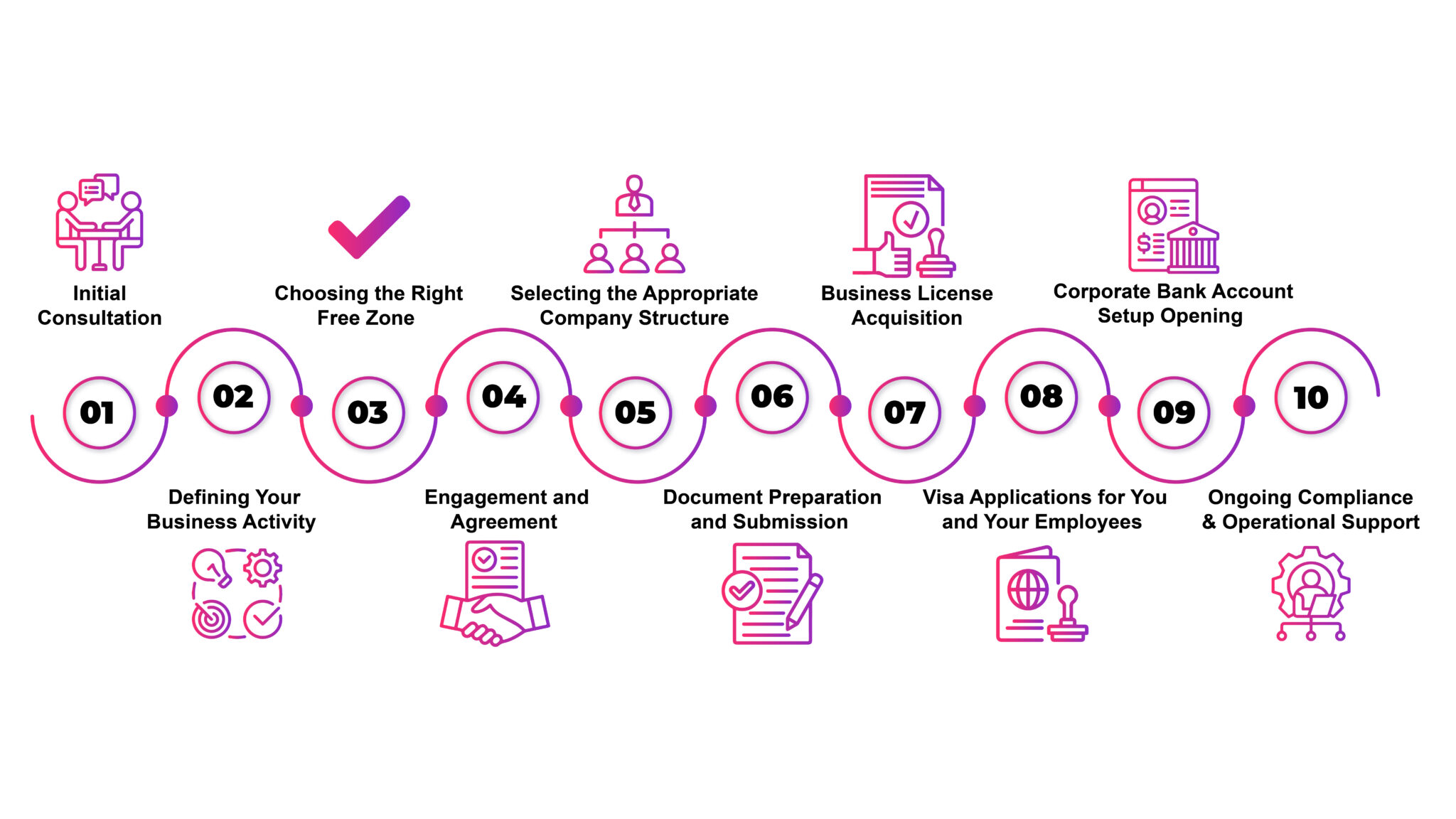

01

01 02

02 03

03 04

04 05

05Key Steps to Setup your business in UAE Freezone with Nimbus Consultancy

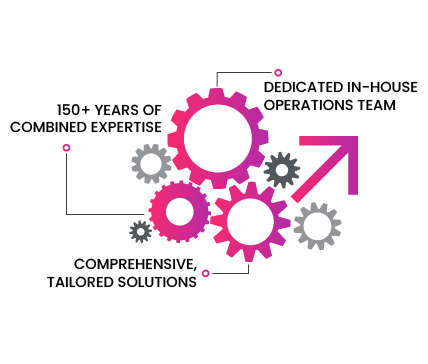

Our on-the-ground experts are fluent in local languages and adept in navigating government procedures, ensuring seamless support within key jurisdictions.

From initial consultation to post-incorporation, we offer a full suite of services, including customized business setup, accounting, bookkeeping, HR, payroll, tax, and audit—everything your business needs, all in one place.

With over 150 years of collective experience, our team has the knowledge and skill to manage complex business cases, providing you with expert guidance and efficient execution every step of the way.

A Free Zone is a designated area where businesses can operate with full ownership, tax exemptions, and simplified import/export procedures. These zones offer advantages for foreign investors.

The process usually involves selecting a Free Zone, submitting necessary documents, selecting the business activity, applying for a business license, and setting up an office space. You may also need to arrange for employee visas.

Currently, transferring your business from one free zone to another is not permitted. However, you do have the option to set up a branch of your existing company in a different free zone.

To open a UAE bank account, you’ll need:

We pride ourselves in having talented and committed individuals with the right blend of aptitude and enthusiasm, who can go the extra mile to help clients achieve desired outcomes, ensuring that they accomplish their objectives with minimum hassle.

"Maddy was amazing throughout our UAE incorporation. She was there to guide us at every turn, making the whole process feel manageable. We really appreciated her help!"

"Collin helped us tackle a tax filing issue that was really urgent. His quick thinking and expertise saved us a lot of stress. We couldn’t have done it without him!"

"We talked to a few companies about expanding to Saudi Arabia, but Nimbus Consultancy was the only one that gave us a clear picture of what to expect. They walked us through everything, and our business was up and running in just four months!"

"When we had a contract ready in the UAE but needed to get our company registered fast, Maddy stepped in. She made sure we were always updated on what was happening. I highly recommend Nimbus Consultancy!"

"Setting up our business in the UAE mainland with Nimbus Consultancy was a smooth experience. Maddy’s support made everything easy to understand. We felt confident every step of the way!"

UAE | KSA | Antigua | Singapore

© Copyright 2026. All Rights Reserved by Nimbus Consultancy