"Maddy was amazing throughout our UAE incorporation. She was there to guide us at every turn, making the whole process feel manageable. We really appreciated her help!"

- 70240 Avenue of the Moon, California

- +4733378901

MISA offers nine primary licenses, each tailored to support diverse business activities, providing clarity and legal backing to foreign investors.

Available Licenses include Services, Professional, Mining, Trading, Entrepreneurial, RHQ (Regional Headquarters), Scientific and Technical Office, Real Estate, and Industrial licenses.

Each license type aligns with sector-specific regulations, allowing companies to operate within legal boundaries and engage in relevant activities.

A 15% VAT rate is applied to goods and services, established to reduce oil dependency in national revenue.

Foreign-owned companies are taxed at a 20% rate, with varying rates in specific sectors like oil and gas.

Ranges between 5% and 15% on non-resident payments, depending on the type of service or transaction.

Levied at 2.5% on Saudi-owned and partially Saudi-owned entities' assets, aligning with Islamic tax principles.

The Nitaqat program mandates companies to meet specific quotas for employing Saudi nationals based on their sector and size, supporting national employment goals.

This platform, managed by the Ministry of Interior, allows businesses to handle foreign employee residency permits, visa renewals, and exit/entry permits, ensuring legal compliance for expatriate staff.

Absher provides streamlined visa processing, work permit management, and other essential services for employers to manage employees’ legal documentation.

Qiwa consolidates various HR services, including labor contract verification and Saudization tracking, and integrates with other platforms like Absher and Muqeem for cohesive employee data management.

Focused on payroll compliance, Mudad ensures adherence to the Wage Protection System (WPS), promoting timely employee payments and safeguarding workers' rights.

The Etimad platform enables businesses to participate in government contracts and facilitates electronic bidding, procurement, and payment processing, improving efficiency for those seeking government partnerships.

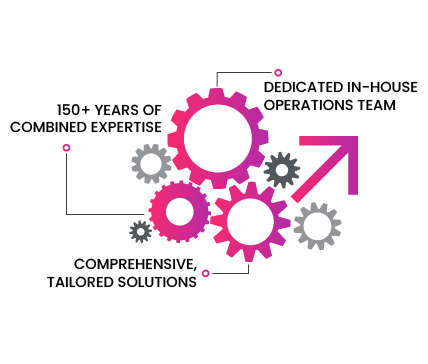

Our on-the-ground experts are fluent in local languages and adept in navigating government procedures, ensuring seamless support within key jurisdictions.

From initial consultation to post-incorporation, we offer a full suite of services, including customized business setup, accounting, bookkeeping, HR, payroll, tax, and audit—everything your business needs, all in one place.

With over 150 years of collective experience, our team has the knowledge and skill to manage complex business cases, providing you with expert guidance and efficient execution every step of the way.

"Maddy was amazing throughout our UAE incorporation. She was there to guide us at every turn, making the whole process feel manageable. We really appreciated her help!"

"Collin helped us tackle a tax filing issue that was really urgent. His quick thinking and expertise saved us a lot of stress. We couldn’t have done it without him!"

"We talked to a few companies about expanding to Saudi Arabia, but Nimbus was the only one that gave us a clear picture of what to expect. They walked us through everything, and our business was up and running in just four months!"

"When we had a contract ready in the UAE but needed to get our company registered fast, Maddy stepped in. She made sure we were always updated on what was happening. I highly recommend Nimbus!"

"Setting up our business in the UAE mainland with Nimbus was a smooth experience. Maddy’s support made everything easy to understand. We felt confident every step of the way!"

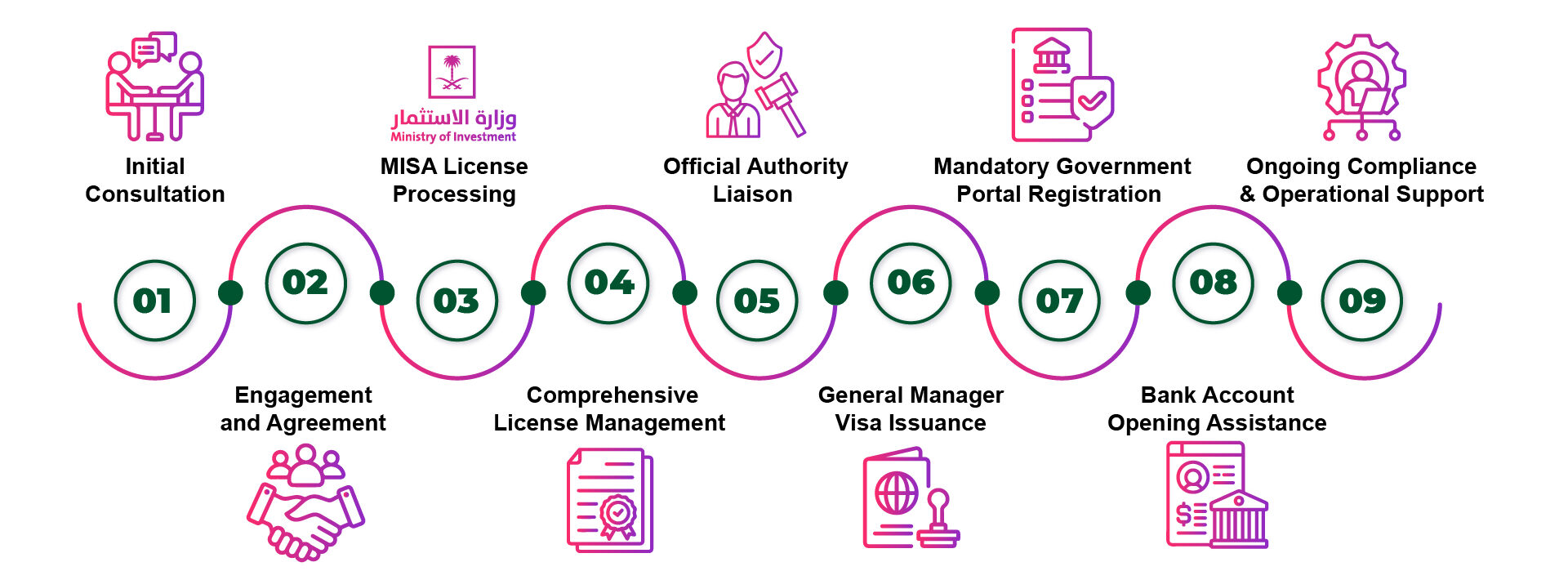

Steps to Set Up a Company in the Saudi Arabia Region

The Ministry of Investment of Saudi Arabia (MISA) offers the Investor License (formerly known as SAGIA license), which allows foreign companies to operate in the Kingdom without the need for a local sponsor. This license enables 100% foreign ownership, especially for businesses in sectors like services. However, some business activities, such as recruitment, consulting, and professional licenses, may have additional requirements or restrictions.

The cost to establish a business in Saudi Arabia varies depending on factors such as the type of business license, office space, number of visas, and other specific needs. For a detailed understanding of costs, it’s recommended to schedule a free consultation with our experts to discuss your unique requirements.

Yes, the appointed general manager must travel to Saudi Arabia to complete the Iqama (residency) process, which is a crucial step for finalizing the company registration and operations in the country.

Foreign-owned businesses in Saudi Arabia are subject to the following taxes:

Zakat is an annual religious tax applicable to Saudi-owned businesses, set at 2.5% of the company’s net worth.

Yes, a registered national address is required to establish a business in Saudi Arabia. We offer coworking office spaces that can serve as your company’s registered address, allowing you to operate efficiently and meet legal requirements.

UAE | KSA | Antigua | Singapore

© Copyright 2026. All Rights Reserved by Nimbus Consultancy