As the UAE’s new Corporate Tax (CT) regime continues to take shape, businesses are fast approaching a critical compliance milestone. By September 30, 2025, all UAE-based businesses within the scope of CT must finalize their FY 2024 audited financial statements, implement transfer pricing (TP) adjustments, and submit all required related-party disclosures.

The new framework, introduced under Federal Decree-Law No. 47 of 2022, imposes a 9 percent corporate tax on taxable profits exceeding AED 375,000. While the tax rate itself is relatively low compared to global standards, the real complexity lies in how companies prepare for it, particularly when it comes to auditing and transfer pricing.

To help businesses meet the deadline confidently and avoid penalties, this post offers an action plan for audit readiness, TP compliance, and successful CT filing. Knowing the steps is also critical for investors looking for business setup in the UAE to ensure compliance in the future.

UAE Corporate Tax Filing 2025 – A Quick Guide

1. Audit of FY 2024 Financial Statements

Every UAE business subject to Corporate Tax, whether on the mainland or in a free zone, must complete and finalize audited financial statements for the financial year ending in 2024.

While the CT deadline is September 30, 2025, many free zone authorities like DMCC and DIFC have aligned their audit deadlines with the federal tax timeline. Failing to complete audits in time could result in delays in filing your CT return.

Moreover, businesses may face administrative penalties, including fines starting at AED 5,000, blocked access to government portals, or even license suspensions. Importantly, the audit must reflect any transfer pricing adjustments that affect profitability.

These adjustments must be calculated and documented before audit sign-off to avoid inconsistencies or the need for post-audit changes, which are not permitted under current regulations.

To stay on track:

- Secure an approved auditor early.

- Coordinate TP documentation and adjustments ahead of audit finalization.

- Integrate all adjustments into your audited accounts before submission.

2. Assessment of Related-Party and Connected-Person Transactions

Transfer pricing obligations are triggered when a business enters into transactions with Related Parties or Connected Persons, as defined under Articles 35 and 36 of the Corporate Tax Law.

To determine whether TP rules apply to your business, first identify all related-party and connected-person relationships. This includes:

- Ownership or control of 50 percent or more, either directly or indirectly.

- Entities under shared control, including through trusts or permanent establishments.

- Natural persons related up to the fourth degree, including through marriage, adoption, or guardianship.

- Corporate structures like parent-subsidiary relationships or sister companies.

Connected Persons include shareholders, directors, officers, and their close family members, as well as partners in unincorporated partnerships.

You must also track thresholds for disclosure:

- AED 40 million in total related-party transactions triggers full TP disclosure.

- AED 4 million per transaction category (e.g., goods, services, interest) must be detailed once the AED 40 million threshold is reached.

- AED 500,000 in transactions with connected persons also triggers reporting.

Failing to identify and assess these transactions accurately can result in an incomplete CT filing or penalties from the Federal Tax Authority (FTA).

3. Transfer Pricing Policy and Benchmarking Study

Once related-party transactions are identified, businesses must prepare a transfer pricing policy and conduct a benchmarking analysis to prove that these transactions meet the arm’s-length principle, that is, they are priced as if between independent parties. Key action items include:

- Maintain a TP policy that is updated every three years, either tailored to the UAE entity or part of a group-wide document.

- Conduct a benchmarking study using OECD-recognized methods such as:

- Comparable Uncontrolled Price (CUP)

- Transactional Net Margin Method (TNMM)

- Cost-Plus Method

- Profit Split Method

- Implement necessary financial adjustments if transaction margins fall outside the acceptable interquartile range. Any downward adjustments that reduce UAE taxable income require prior approval from the FTA.

- Ensure all adjustments are included in your financial statements before audit sign-off.

Post-audit changes to transfer pricing positions are generally not allowed, making early preparation crucial.

4. CT Filing and TP Disclosure Obligations

The Corporate Tax return requires disclosure of all related-party and connected-person transactions. If the thresholds are exceeded, you must file a Transfer Pricing Disclosure Form alongside the CT return.

Additionally, if the group’s global revenue exceeds AED 3.15 billion or the UAE entity’s local revenue exceeds AED 200 million, the business must also prepare:

- A Master File, outlining the group’s global structure and policies.

- A Local File, detailing the UAE entity’s specific intercompany transactions.

These documents must be ready by the filing date and retained in case the FTA requests them. The FTA may issue a request for documentation with as little as 30 days’ notice, so prepare and finalize ahead of the CT return deadline.

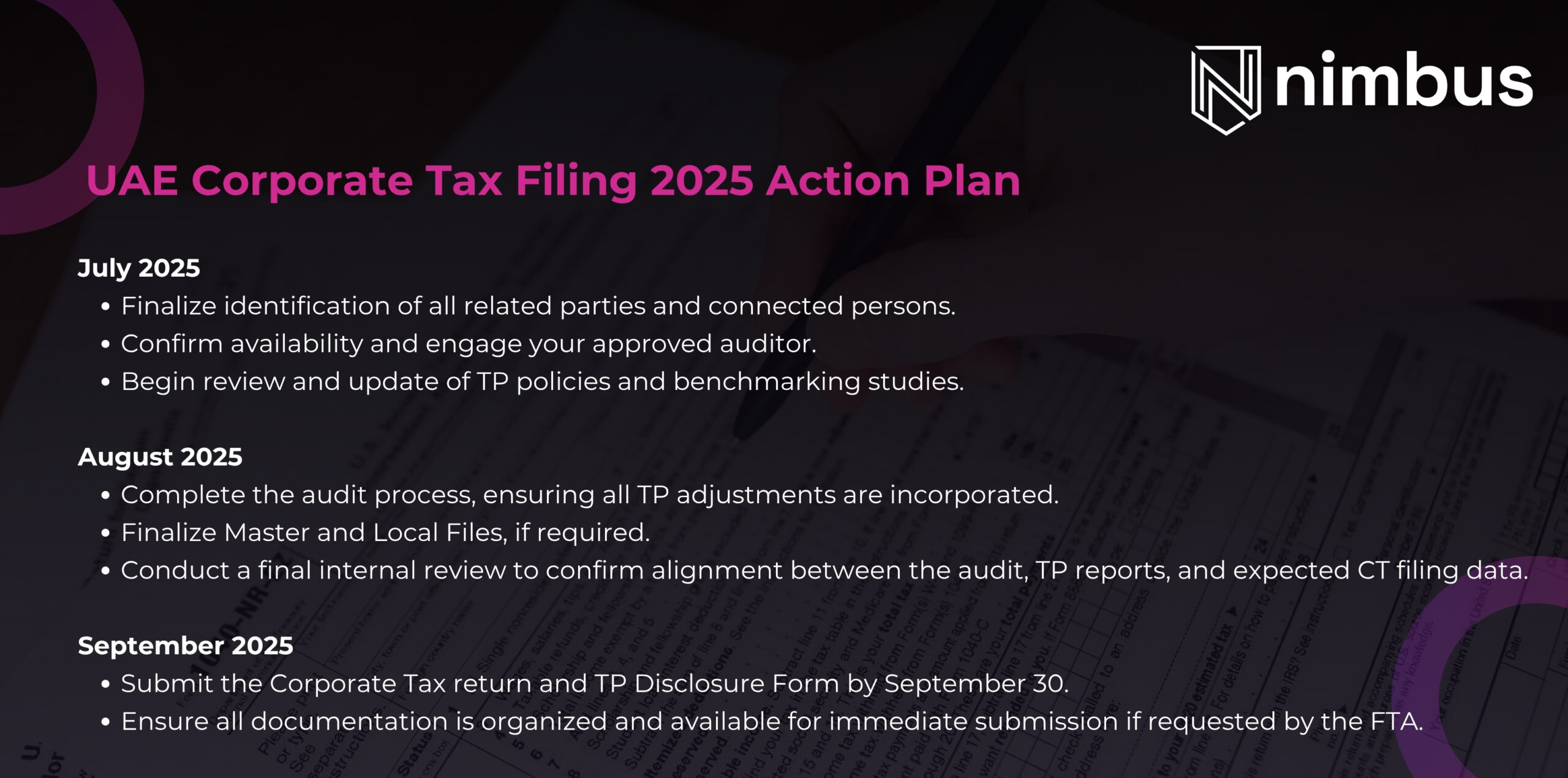

5. UAE Corporate Tax Filing 2025 Action Plan

To help businesses prepare without last-minute panic, here’s a suggested action plan for the final quarter before the filing deadline.

July 2025

- Finalize identification of all related parties and connected persons.

- Confirm availability and engage your approved auditor.

- Begin review and update of TP policies and benchmarking studies.

August 2025

- Complete the audit process, ensuring all TP adjustments are incorporated.

- Finalize Master and Local Files, if required.

- Conduct a final internal review to confirm alignment between the audit, TP reports, and expected CT filing data.

September 2025

- Submit the Corporate Tax return and TP Disclosure Form by September 30.

- Ensure all documentation is organized and available for immediate submission if requested by the FTA.

Conclusion

The 2025 Corporate Tax filing deadline is more than just a due date, it represents a key test of how well UAE businesses can adapt to a more complex regulatory environment and how investors going for company formation in the UAE must look forward to in the future.

Audit readiness, transfer pricing accuracy, and documentation discipline are now essential elements of compliance.

By acting now and following a structured plan, businesses can meet the September 30 deadline with confidence, avoid penalties, and demonstrate their commitment to regulatory excellence in the UAE.