The Gulf region has become one of the most dynamic and competitive business destinations in the world. The UAE and Saudi Arabia, in particular, are not only economic powerhouses but also key gateways for companies looking to expand across the Middle East.

Together, they represent vast opportunities for businesses that want access to growing markets, capital, and government-backed reforms. But with opportunity comes complexity.

Both the UAE and Saudi Arabia now enforce corporate tax regimes: the UAE introduced a 9% federal corporate tax in 2023 on profits above AED 375,000, while Saudi Arabia maintains a 20% corporate tax rate.

Add to that differing VAT regimes, 5% in the UAE and 15% in Saudi Arabia and businesses face a delicate balancing act to remain compliant while minimizing tax costs amidst other regulatory requirements for business setup in the UAE and KSA.

This article explores practical strategies for companies operating across both jurisdictions to manage their tax exposure, avoid double taxation, and build sustainable structures for growth.

Comparing the Tax Landscape of UAE and Saudi Arabia

Understanding the fundamentals of each jurisdiction is the first step in effective planning.

- UAE: Corporate tax of 9% (profits above AED 375,000) and VAT at 5%. The country has multiple free zones, some of which allow qualifying companies to benefit from preferential 0% corporate tax rates. However, navigating UAE freezone rules requires strict compliance, and non-qualifying firms can be taxed at the full rate.

- Saudi Arabia: Corporate tax of 20% and VAT at 15%. The country is aggressively expanding under Vision 2030, and the tax authority (ZATCA) has become increasingly vigilant, especially regarding transfer pricing and cross-border transactions.

For companies operating in both jurisdictions, this dual setup can create both advantages and challenges. The UAE’s relatively lower tax rate makes it an attractive jurisdiction for back-office, service, and holding company functions. At the same time, Saudi Arabia remains an essential market, but its higher tax cost requires careful structuring.

The Pros and Cons of Dual Jurisdiction Operations

1. Pros

- Access to two of the region’s most important markets

- Potential to optimize taxes through cross-border structuring

- Opportunities to leverage UAE’s free zone incentives and tax credits

2. Cons

- Complex compliance requirements across two jurisdictions

- Increased risk of double taxation if structures are not aligned

- Greater focus from regulators on transfer pricing and related-party transactions

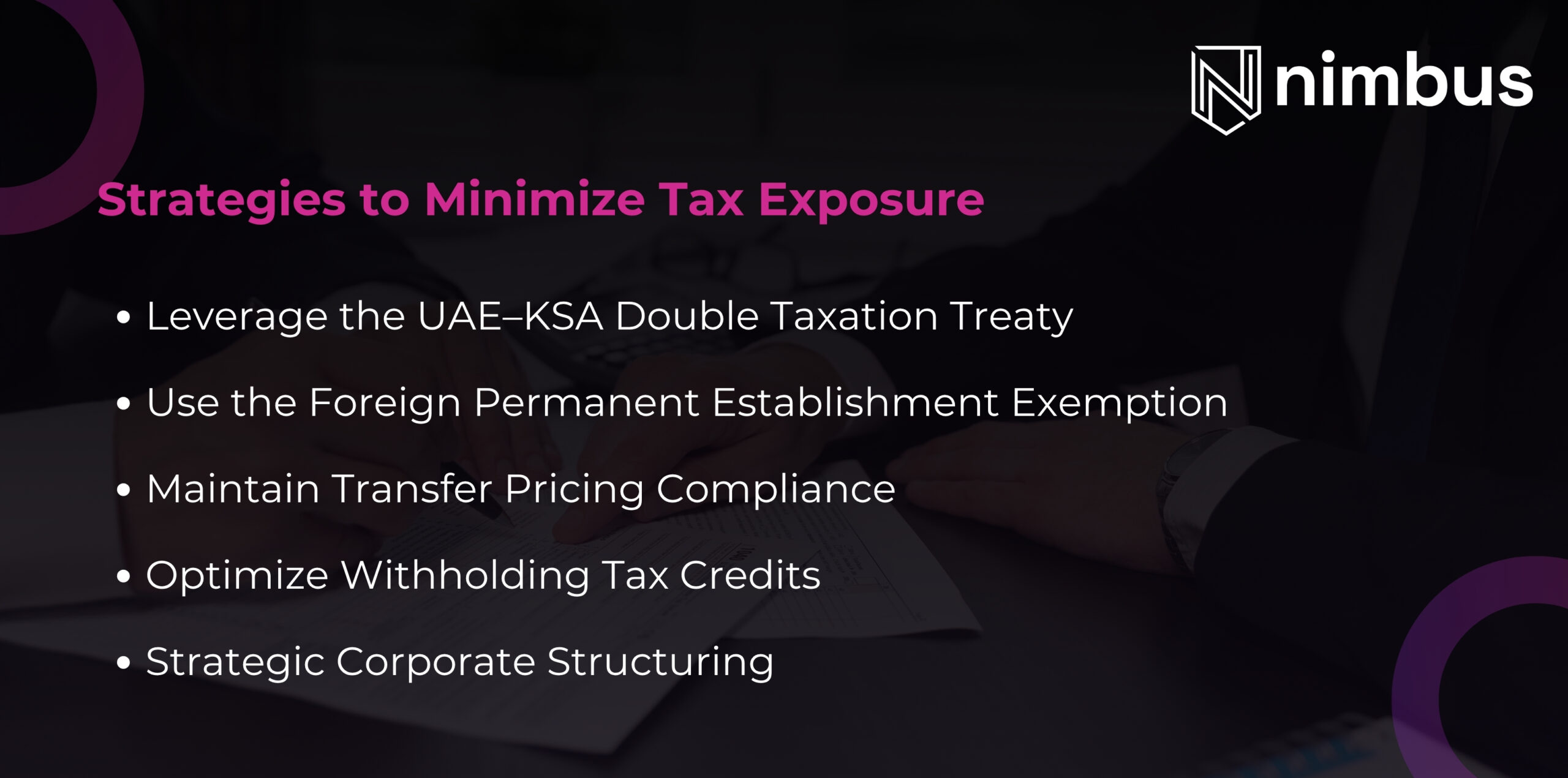

Strategies to Minimize Tax Exposure

- Leverage the UAE–KSA Double Taxation Treaty

The treaty between the two countries is designed to prevent businesses from being taxed twice on the same income. Under the treaty, companies can access credits or exemptions on certain types of income. - Leverage the UAE–KSA Double Taxation Treaty

The treaty between the two countries is designed to prevent businesses from being taxed twice on the same income. Under the treaty, companies can access credits or exemptions on certain types of income. - Maintain Transfer Pricing Compliance

Both the UAE and Saudi Arabia enforce the Arm’s Length Principle for related-party transactions. Artificially shifting profits from Saudi Arabia to the UAE by inflating costs can trigger audits and penalties. Proper documentation and compliance with ZATCA and the UAE’s Federal Tax Authority (FTA) guidelines are critical. - Optimize Withholding Tax Credits

Saudi Arabia applies withholding tax rates between 5% and 20% on payments made to foreign entities, including service fees paid to UAE companies. While UAE companies can often claim credits against their domestic corporate tax liability, the maximum offset is capped at 9%. Any withholding tax paid above that limit cannot be recovered. Businesses must carefully manage contract terms and documentation to avoid unnecessary losses. - Strategic Corporate Structuring

Many firms benefit from setting up a UAE-based parent company that owns a Saudi subsidiary. This allows Saudi profits to be taxed locally, while the UAE parent applies the foreign permanent establishment exemption. This type of structure also simplifies VAT registration and improves overall governance.

Frequently Asked Questions

1. Can I do business in Saudi Arabia without a local entity?

Yes, but this creates significant risks. Without a branch or subsidiary, your company may be deemed to have a permanent establishment, leading to withholding taxes and additional compliance burdens. Setting up a local entity is generally the safer and more tax-efficient option.

2. What is the risk of ignoring transfer pricing rules?

Very high. ZATCA and the FTA closely monitor cross-border related-party transactions. Non-compliance could lead to heavy fines and reputational risks.

3. Do all UAE free zones offer 0% corporate tax?

No. Only Qualifying Free Zone Persons (QFZPs) meeting specific criteria can benefit from the 0% rate. If your company does not meet the rules, it will be taxed at 9%. Companies must review their status regularly to avoid unexpected liabilities.

How Nimbus Consultancy Can Help?

At Nimbus Consultancy, we specialize in supporting businesses that operate across the GCC. Our services include:

- Designing corporate structures tailored for business setup services in Saudi Arabia and UAE and their tax regimes

- Advising on cross-border tax planning and treaty applications

- Preparing transfer pricing documentation and benchmarking reports

- Managing VAT planning, registration, and compliance

The UAE and Saudi Arabia represent two of the most promising markets in the Middle East, but companies operating in both must plan carefully to manage tax exposure.

By leveraging the double taxation treaty, applying exemptions, maintaining transfer pricing compliance, and structuring operations strategically, businesses can minimize liabilities while maintaining full compliance.

Nimbus Consultancy works with businesses to navigate these complexities, offering expert guidance that helps companies grow confidently across borders.