In Saudi Arabia’s fast-evolving regulatory landscape, compliance doesn’t end with company formation; it begins there. As the Kingdom accelerates its Vision 2030 diversification plan, foreign investors and local enterprises alike are expected to maintain strict adherence to business license renewal requirements.

Whether you’ve completed your business setup in Saudi Arabia or are in the process of expanding operations, understanding how and when to renew your licenses can make the difference between seamless continuity and costly disruption.

Why License Renewal Management Matters?

A company’s regulatory obligations in Saudi Arabia extend well beyond initial registration. Licenses act as the operational backbone, right from your MISA investment license and Commercial Registration (CR) to the General Manager’s Iqama.

Failure to renew even one of these documents on time can trigger a chain reaction: suspended operations, bank account freezes, blocked access to government portals like Qiwa and Muqeem, and even license revocation.

In short, staying compliant isn’t optional. It’s a core strategic requirement to stay and grow in the Kingdom.

License Renewals in Saudi Arabia: Important Things to Know

1. MISA License: The Cornerstone of Compliance

Every foreign company engaged in company formation in the KSA begins with the MISA (Ministry of Investment of Saudi Arabia) license. This is the foundation of legal business operations, enabling 100% foreign ownership and providing access to a host of investment incentives.

The MISA license is valid for one year, requiring annual renewal supported by up-to-date documentation. To renew successfully, businesses must submit:

- A copy of the original MISA license

- An active Commercial Registration (CR)

- A valid ZATCA (Tax Authority) certificate

Companies with expired CRs, inactive bank accounts, or outdated ZATCA records are at high risk of license rejection or revocation. The renewal process is increasingly digitized, but the responsibility for ensuring that supporting records are valid remains with the business.

Insight: The MISA renewal process is an administrative formality and a periodic review of your operational health. Businesses that maintain active tax and banking compliance rarely face renewal challenges.

2. Commercial Registration (CR): New Annual Confirmation Rules

Under the latest 2025 reforms, the Ministry of Commerce replaced the traditional annual CR renewal system with an Annual Data Confirmation model. Companies no longer need to reissue their CR each year.

Instead, they must confirm and update their commercial data while paying the applicable fees through the Ministry’s online platform. Failure to comply with this process can have serious consequences like:

- After 90 days of non-confirmation → CR status changes to “Suspended”

- After 1 year of non-confirmation → CR is “Cancelled”

During suspension, companies can reactivate by providing updated information and clearing any outstanding fees, but a canceled CR requires a new application, which can be an expensive and time-consuming process.

Insight: This reform aligns with Saudi Arabia’s push to digitize and streamline business licenses in Saudi Arabia, but it also places greater accountability on companies to keep their information current.

3. The General Manager’s Iqama: A Critical Link in the Compliance Chain

The General Manager’s Iqama (residency permit) is often overlooked, but it plays a pivotal role in maintaining valid business operations. Without a renewed Iqama, your business may face:

- Delays in MISA license renewals

- Temporary suspension of bank accounts

- Disruption to core administrative and HR functions

Iqama renewal fees typically range from SAR 163 (3 months) to SAR 650 (annual), depending on the chosen duration. Processing takes about 1–2 working days, assuming work permit fees are paid in advance.

Insight: The Iqama is not merely an immigration document — it’s a functional key that unlocks your company’s ability to interact with the entire Saudi regulatory ecosystem.

4. How to Stay Proactively Compliant?

Effective compliance in Saudi Arabia requires an integrated approach. Each license — MISA, CR, ZATCA, Chamber of Commerce, and Iqama — is interconnected. If one expires, the others may be affected. To maintain full operational readiness:

- Map renewal cycles for all licenses and assign internal responsibility for monitoring dates.

- Use digital reminders or compliance management tools to track renewal deadlines.

- Update commercial data annually under the new Ministry of Commerce rules.

- Maintain active tax, bank, and Chamber of Commerce accounts to avoid rejection of renewals.

Pro tip: Many firms now outsource license management to specialized consultants who handle the full renewal process, ensuring nothing slips through regulatory cracks.

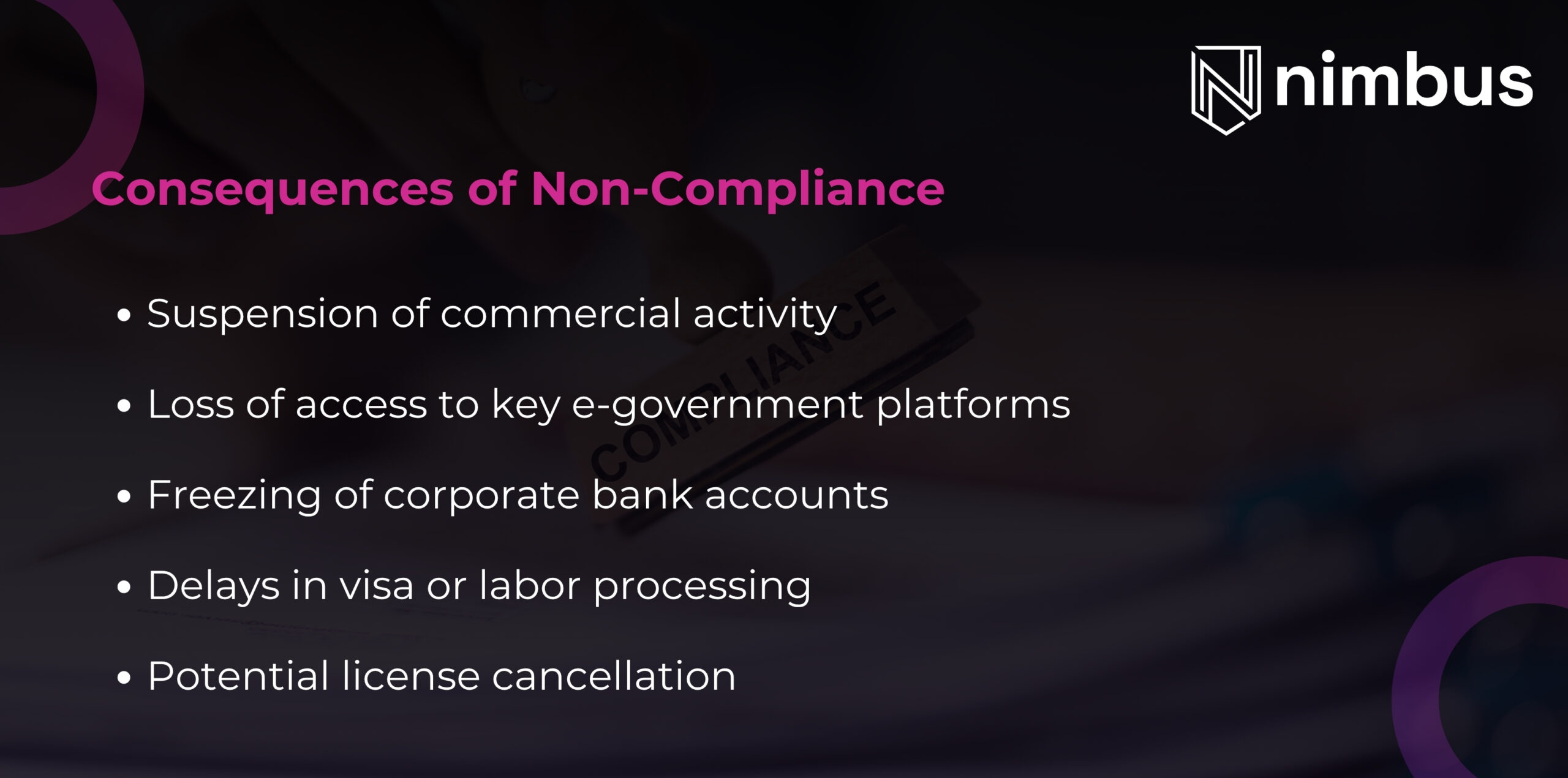

5. Consequences of Non-Compliance

Ignoring renewal timelines can trigger immediate regulatory actions such as:

- Suspension of commercial activity

- Loss of access to key e-government platforms

- Freezing of corporate bank accounts

- Delays in visa or labor processing

- Potential license cancellation

But the hidden cost is even greater and that is reputational risk. Repeated lapses may lead regulators to question your company’s operational credibility, which can affect tenders, partnerships, and future expansion approvals.

6. Professional Support for Renewal Management

Saudi Arabia’s regulatory framework continues to evolve rapidly, especially for foreign investors. Partnering with a business setup services provider in Saudi Arabia or a local compliance consultant can help you navigate these updates efficiently.

Professional support ensures that your renewal documentation, from ZATCA to MISA, is properly sequenced and submitted without interruption. This proactive approach safeguards your company’s legal standing and ensures uninterrupted operations.

Staying Compliant in Saudi Arabia

Saudi Arabia’s investment environment has never been more open, but also never more structured. Companies entering or operating in the Kingdom must treat license renewals as part of their core operational strategy.

If you’re uncertain about your company’s current license or compliance status, consider partnering with an advisory firm that specializes in business setup in Saudi Arabia and ongoing regulatory management.