Arbitration is now a cornerstone of commercial and cross-border dispute resolution in the Gulf Cooperation Council (GCC). With growing international investment and an expanding trade network, businesses are increasingly looking for arbitration centres that offer neutrality, and enforceability.

In this competitive landscape, Saudi Arabia and the UAE have positioned themselves as rival hubs for international arbitration, each modernizing their legal frameworks to attract global investors.

Saudi Arabia’s latest move, the release of the 2023 revised arbitration rules by the Saudi Center for Commercial Arbitration (SCCA) has become a significant step in this direction.

The new rules, which came into effect on May 1, 2023, reflect international best practices, while introducing innovations that address both global standards and the specific needs of the Saudi market.

For investors considering business setup in Saudi Arabia, these reforms not only strengthen dispute resolution mechanisms but also reinforce the Kingdom’s appeal as a reliable business destination.

Evolution of Arbitration in Saudi Arabia

The development of arbitration in Saudi Arabia has been deliberate and strategic. The establishment of the SCCA in 2014 marked the country’s first institutional effort to provide professional arbitration and mediation services.

Offering proceedings in both Arabic and English, the SCCA became an institution designed to support domestic businesses while remaining accessible to international investors.

In 2022, the creation of the independent SCCA Court brought Saudi Arabia closer to the structures of leading institutions like the ICC and LCIA. The SCCA Court has authority over key procedural matters such as arbitrator appointments, consolidation requests, and award scrutiny.

This supervisory framework added credibility and consistency, making arbitration in Saudi Arabia more attractive to businesses setting up operations in the Kingdom.

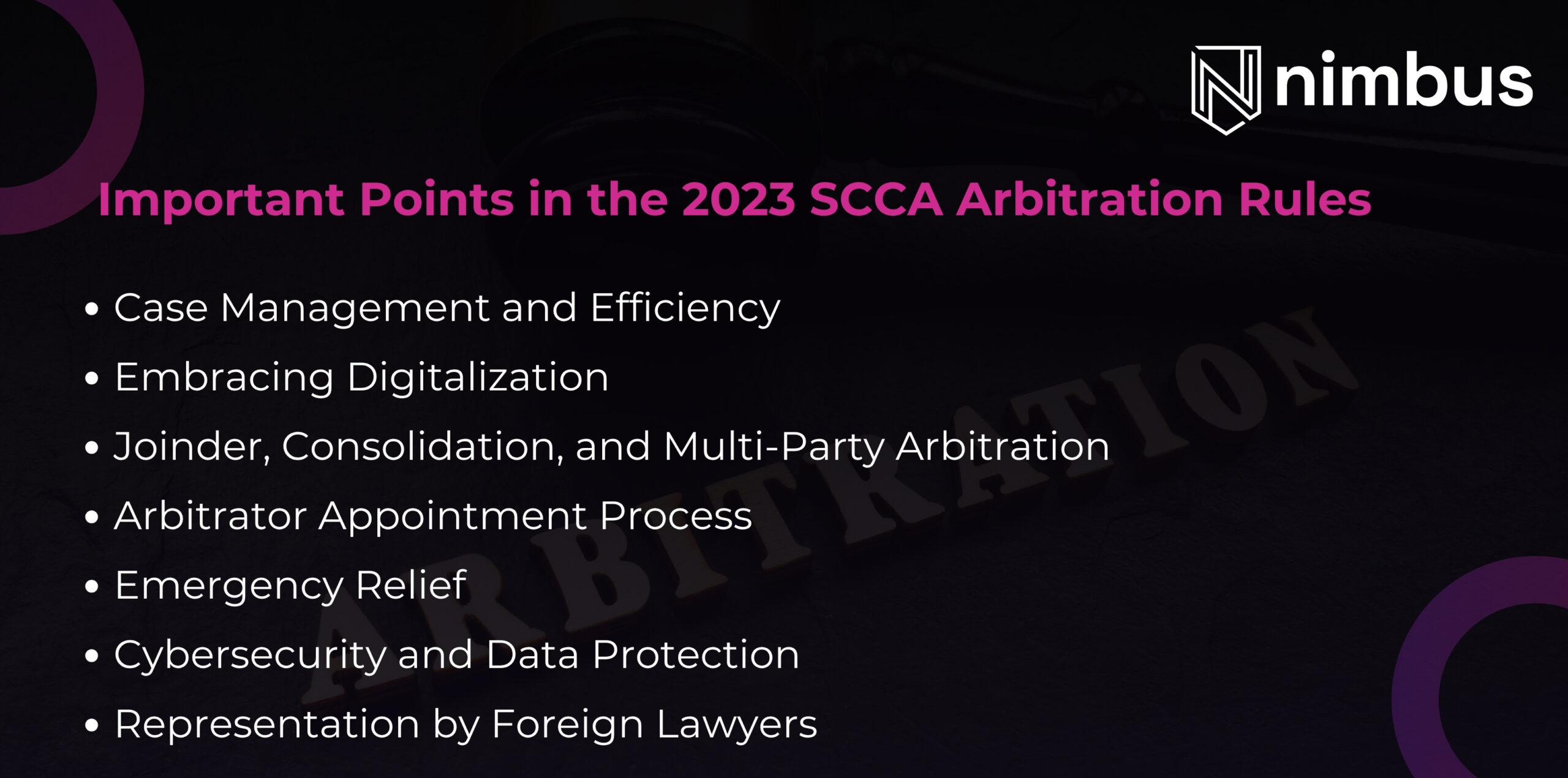

Important Points in the 2023 SCCA Arbitration Rules

The 2023 revisions to the SCCA Arbitration Rules introduced several important changes that align with global arbitration practices while catering to regional realities.

1. Case Management and Efficiency

- The threshold for expedited proceedings was raised to SAR 4 million (about US$1.07 million), higher than that applied under Dubai’s DIAC but lower than the ICC threshold.

- Under expedited procedures, tribunals must deliver final awards within 180 days, ensuring faster and less costly outcomes.

- Article 26 introduces early dismissal, allowing tribunals to reject claims or defenses that are manifestly without merit within 30 days. This mechanism curbs misuse of arbitration while preserving due process.

2. Embracing Digitalization

- Awards are now signed electronically, and electronic submission of pleadings and notices is the default.

- For disputes below SAR 200,000 (around US$53,000), Online Dispute Resolution (ODR) is mandatory, with Riyadh as the default seat and Arabic as the default language.

- These measures support environmentally conscious arbitration practices, aligning with global “green arbitration” protocols.

3. Joinder, Consolidation, and Multi-Party Arbitration

- The rules expand opportunities to consolidate claims and allow joinder of additional parties where disputes are linked by a common legal relationship.

- This change mirrors provisions found in ICC, DIAC, and LCIA rules, providing parties with flexibility in complex cases.

4. Arbitrator Appointment Process

- The “list method” has been introduced, giving both parties identical lists of potential arbitrators to rank. If no agreement is reached, the SCCA Court makes the appointment.

- This system increases transparency while maintaining party autonomy.

5. Emergency Relief

- Emergency arbitrators must now issue their decision within 14 days of receiving the case file.

- Parties requesting emergency relief must file a request for arbitration within 10 days, ensuring that the mechanism is tied to ongoing proceedings.

6. Cybersecurity and Data Protection

- Article 46 establishes detailed guidance for information security, setting out five factors for tribunals and parties to consider when assessing cybersecurity measures.

- This level of detail exceeds that of many institutions, reflecting the importance of data protection in modern arbitration.

7. Representation by Foreign Lawyers

- The rules explicitly confirm that parties may appoint foreign lawyers. This clarification resolves prior uncertainties and ensures international businesses can rely on counsel of their choice.

What This Means for Businesses?

For companies exploring business setup in Saudi Arabia, the updated arbitration rules are a signal of the Kingdom’s readiness to support international commerce.

Arbitration is often a deciding factor for investors evaluating risk in new markets, and the SCCA’s modernized framework provides reassurance in several ways:

- Efficiency: Faster timelines and early dismissal prevent lengthy disputes.

- Flexibility: Expanded rules for joinder and consolidation suit multi-party commercial arrangements.

- Accessibility: Lower fees and ODR options make arbitration affordable for SMEs.

- Global Compatibility: Recognition of foreign lawyers and cybersecurity provisions align with international expectations.

These features not only make arbitration in Saudi Arabia more practical but also strengthen the Kingdom’s reputation as a business-friendly jurisdiction. For foreign investors, they represent another reason to view Saudi Arabia business setup as a strategic move.

Arbitration Rules – The Sturdy Regulatory Framework

Saudi Arabia’s 2023 SCCA Arbitration Rules reflect a decisive shift toward international best practices while introducing innovative mechanisms tailored to the region. For businesses engaged in cross-border contracts across the GCC, these reforms offer an efficient, reliable, and affordable forum for dispute resolution.

More broadly, they signal Saudi Arabia’s determination to align its commercial framework with global standards, an encouraging development for international investors considering company formation in the KSA.