Saudi Arabia’s evolving tax environment is reshaping how companies proceed with business setup in the KSA including operational and growth aspects for the future.

With the Zakat, Tax, and Customs Authority (ZATCA) intensifying audits and rolling out digital systems like e-invoicing, compliance has become a central business priority.

Failure to comply with Saudi’s tax regulations can result in steep fines and operational risks, especially for companies with weak internal structures

This article breaks down Saudi Arabia’s current tax regime, the implications of ownership and legal form, and the strategies businesses need to adopt to stay compliant in 2025 and beyond. Let’s have a look.

1. Main Pillars of Saudi Arabia’s Tax System

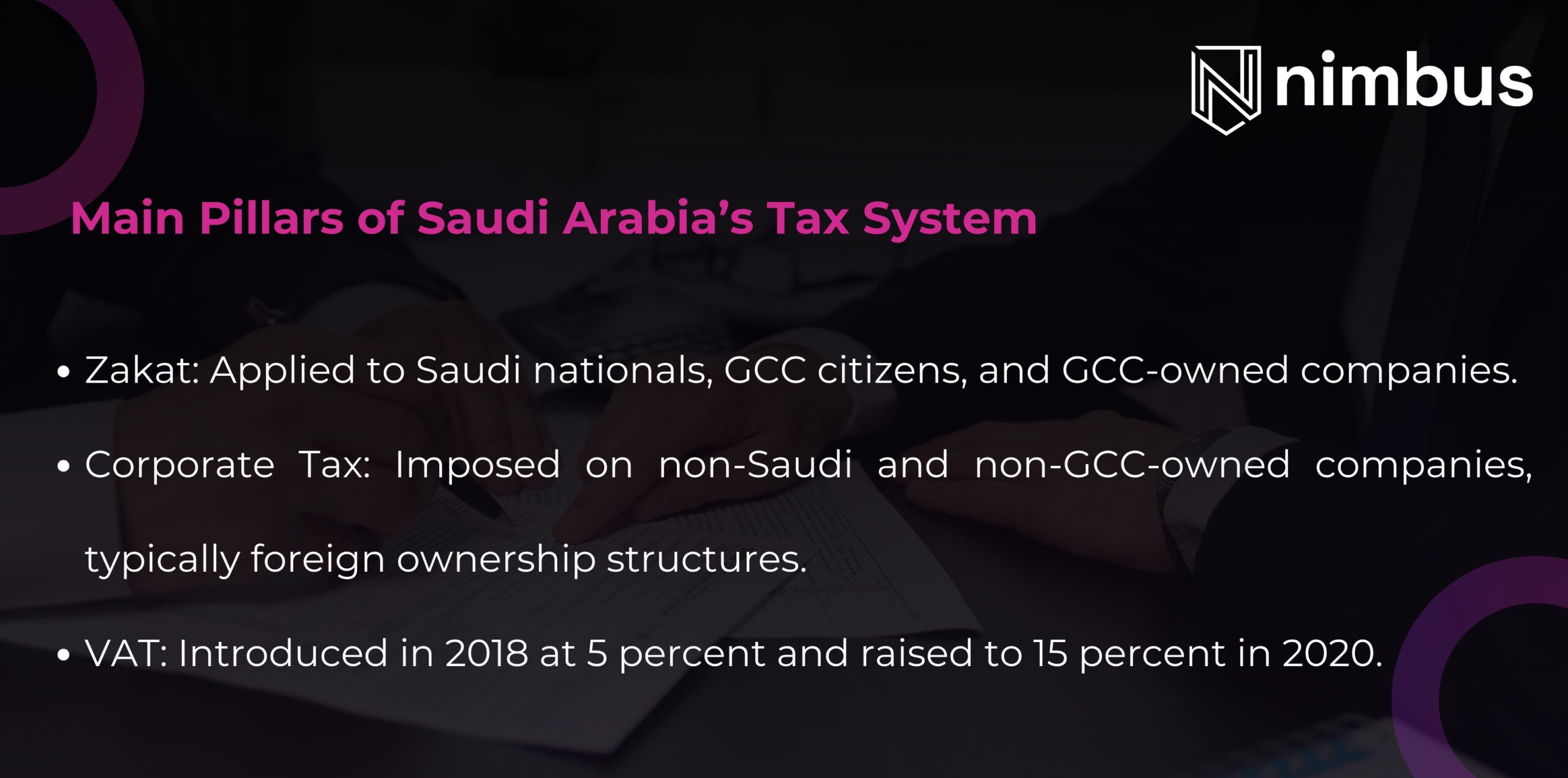

The Saudi tax system is built on three main pillars: Zakat, Corporate Tax, and Value-Added Tax (VAT). Each applies differently depending on ownership, business activity, and revenue levels.

- Zakat: Applied to Saudi nationals, GCC citizens, and GCC-owned companies. The rate is 2.5 percent of net assets after deducting liabilities.

- Corporate Tax: Imposed on non-Saudi and non-GCC-owned companies, typically foreign ownership structures. The standard rate is 20 percent on profits.

- VAT: Introduced in 2018 at 5 percent and raised to 15 percent in 2020. Businesses with annual revenues above SAR 375,000 must register and file VAT returns. Registration is required within 20 days of reaching the threshold.

The combination of these taxes ensures that both local and foreign entities contribute to the Kingdom’s fiscal system, which underpins Vision 2030 and its diversification goals.

2. The Role of Ownership Structure

Ownership determines whether a company is subject to Zakat or corporate tax.

- GCC-owned entities pay Zakat at 2.5 percent of their net assets. This relatively low rate makes GCC participation in company ownership advantageous from a tax perspective.

- Foreign-owned companies are subject to corporate tax, especially in capital-intensive industries.

Saudi Arabia’s extensive network of over 50 double taxation treaties offers relief by reducing withholding tax (WHT) rates on cross-border payments such as dividends, royalties, and management fees.

These rates, which typically range from 5 to 15 percent, can sometimes be reduced to zero under treaty provisions. This provides international investors with opportunities to optimize their tax exposure through thoughtful structuring while ensuring a beneficial company formation in Saudi Arabia.

3. Legal Form and Licensing Implications

Tax treatment varies significantly depending on the chosen legal structure and licensing type Here are the main options.

- Limited Liability Companies (LLCs): Popular among service-based businesses due to flexibility and limited liability. Their taxation depends on ownership composition, with GCC ownership leading to Zakat obligations and foreign ownership leading to corporate tax.

- Public Joint-Stock Companies: Required in certain sectors such as banking and insurance. These companies face stricter oversight but benefit from access to capital markets.

- Branches of Foreign Companies: Considered permanent establishments. They pay a flat 20 percent corporate tax and are exempt from Zakat, as there is no GCC ownership. While they offer quick market entry, branches are not ideal for long-term tax efficiency.

- Regional Headquarters (RHQ): A strategic option for multinationals. Qualifying RHQs enjoy a 0 percent corporate income tax rate and 0 percent withholding tax on payments to non-residents. This makes them highly attractive for global firms centralizing operations in Riyadh under Vision 2030.

The choice of entity type directly impacts not only tax exposure but also compliance obligations, making it a critical early-stage decision.

4. Withholding Tax and Transfer Pricing Rules

Withholding tax applies to payments made to non-residents for services, royalties, management fees, and dividends. Standard WHT rates include:

- Dividends: 5 percent

- Royalties: 15 percent

- Management and technical service fees: 20 percent

Businesses often face challenges in managing WHT, especially when related-party transactions are involved. For example, intercompany management fees must be structured carefully. If these fees are reclassified as cost reimbursements rather than taxable services, they may be exempt from WHT.

Transfer pricing rules, aligned with OECD guidelines, are another compliance layer. Any related-party transactions above SAR 6 million require proper documentation, including master and local files. Choosing the wrong method or failing to provide documentation can result in penalties or adjustments, which are costly and disruptive.

5. Audit Preparedness and Documentation

Tax audit readiness is a must in Saudi Arabia as vZATCA conducts recurring audits, and with the rollout of mandatory e-invoicing, businesses face heightened scrutiny. Non-compliance can lead to financial penalties and reputational damage. Here’s a few thigs businesses can practice:

- Maintaining records for at least five years, including Zakat and income tax calculations, VAT filings, and transfer pricing documentation.

- Submitting quarterly VAT returns and annual Zakat or corporate tax returns within four months of the fiscal year-end.

- Ensuring related-party transactions are well-documented and justified under transfer pricing rules.

- Periodic internal reviews to identify gaps before official audits.

By embedding audit preparedness into routine operations, companies can minimize disruptions and protect themselves from costly disputes with tax authorities.

The Importance of Corporate Restructuring

Corporate restructuring is often necessary to optimize tax exposure, especially for companies with significant cross-border dealings. Through restructuring, businesses can:

- Lower WHT on related-party payments by using treaty networks or reclassifying charges.

- Separate taxable and non-taxable activities to simplify reporting.

- Position themselves to qualify for favorable regimes such as the RHQ program.

Moving Forward: Compliance as Strategy

Saudi Arabia’s tax system acts as a tool for shaping corporate strategy. By understanding how Zakat, VAT, and corporate tax interact, businesses can position themselves to capture opportunities in one of the GCC’s fastest-growing markets.

Foreign companies must weigh their ownership structures, treaty networks, and choice of legal form carefully for a tax compliant business incorporation in the KSA. All companies, regardless of ownership, must prepare for the audit environment and embrace digital compliance systems like e-invoicing.

Is Your Saudi Business Tax Ready?

In 2025, compliance with Saudi’s tax regulations is about building resilience, credibility, and trust in the market. Companies that take a proactive approach will be better positioned to thrive in an economy increasingly focused on transparency.