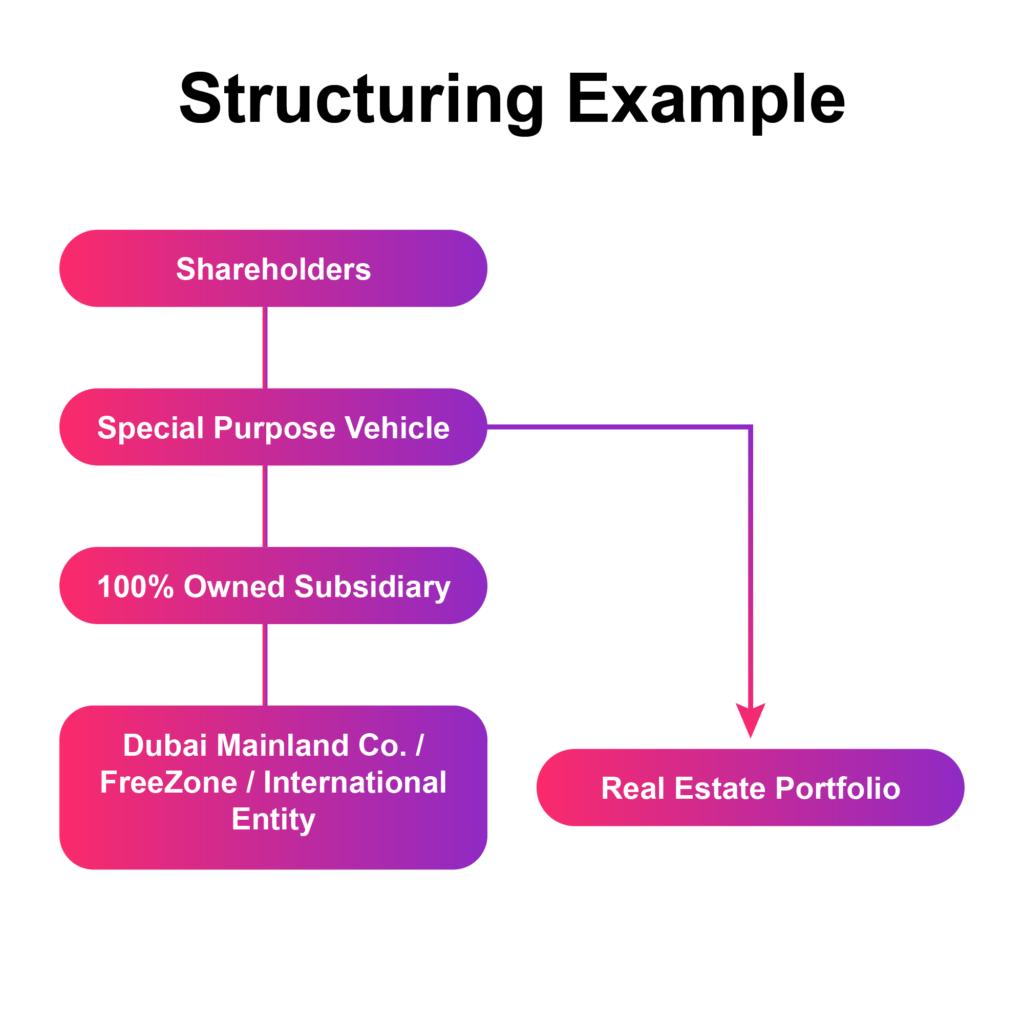

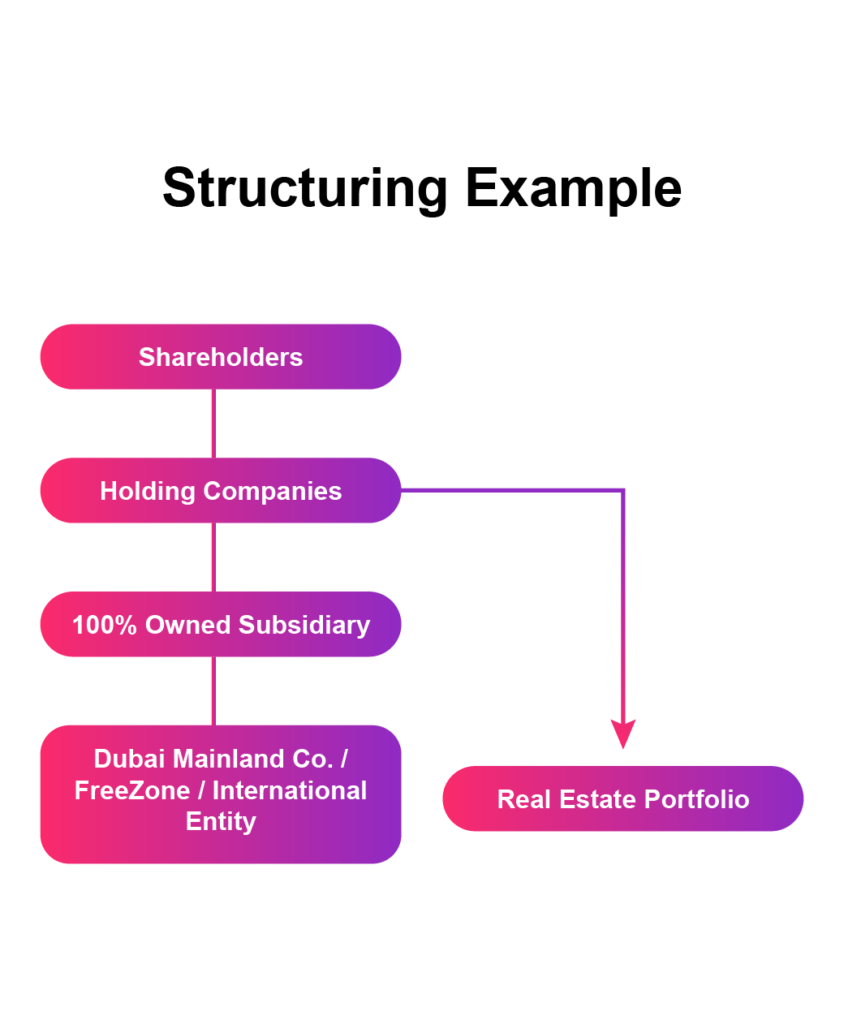

SPVs & Holding Companies in the UAE

SPVs and holding companies in UAE isolate risks, optimize assets, and enhance investment protection efficiently.

SPVs and holding companies in UAE isolate risks, optimize assets, and enhance investment protection efficiently.

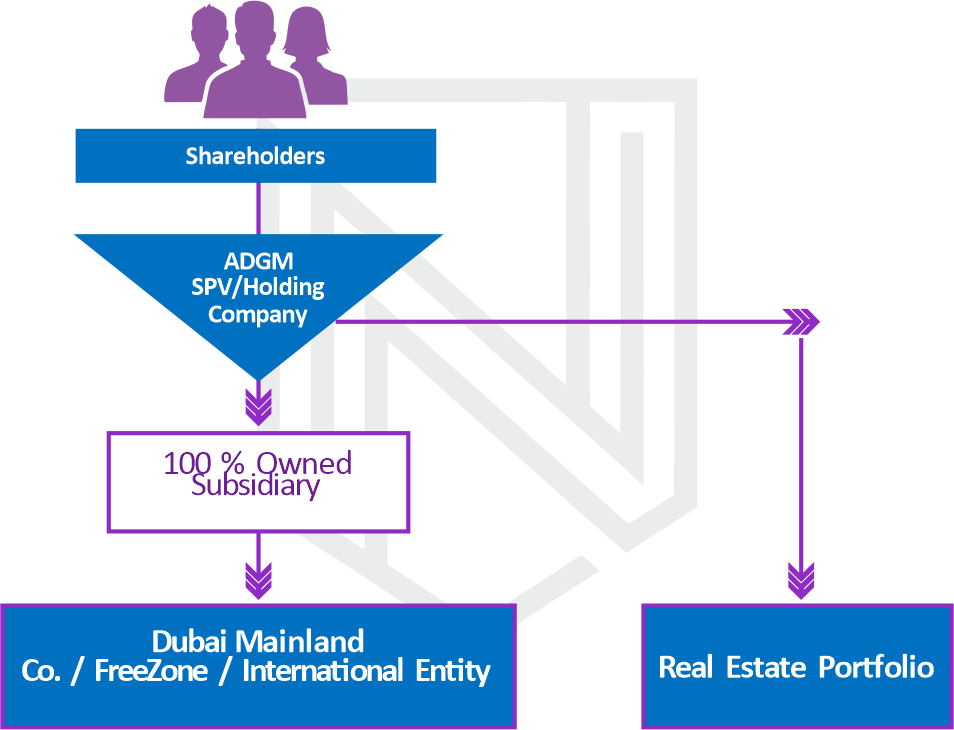

Governed by the UAE Commercial Companies Law, can own mainland/free zone shares.

100% foreign ownership, tax benefits, simplified regulations.

For global asset holding, not for direct UAE market activity.

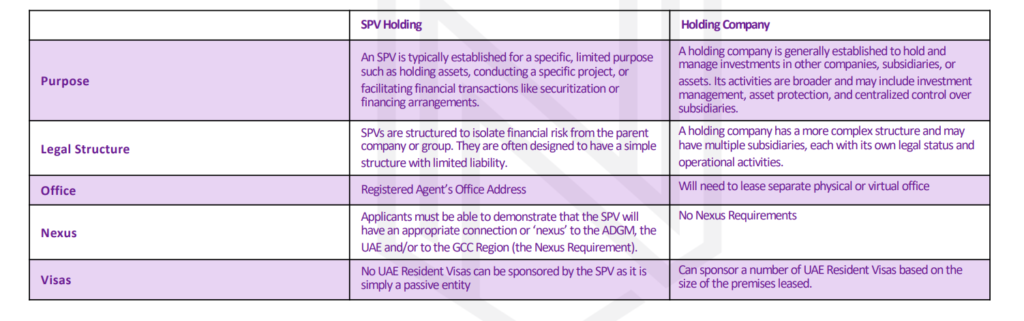

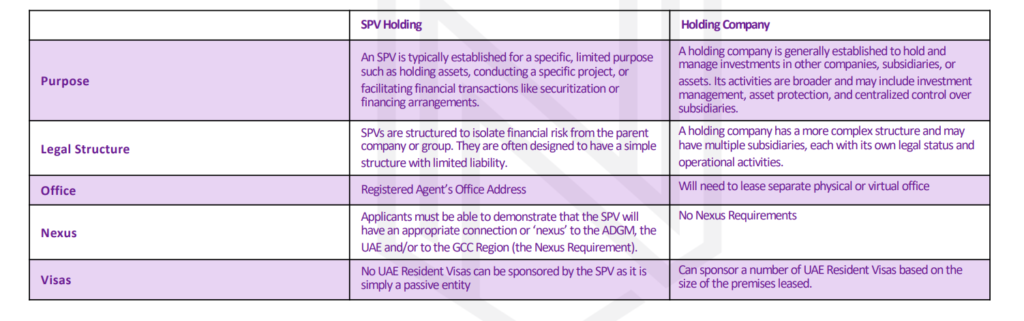

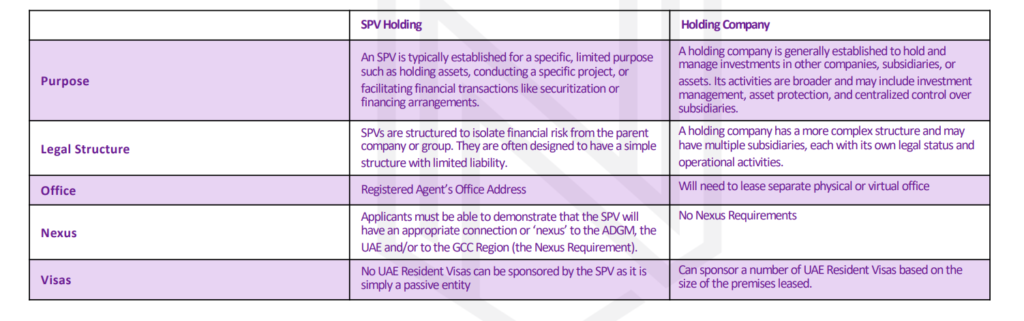

| SPV Holding | Holding Company | |

|---|---|---|

| Purpose | An SPV is typically established for a specific, limited purpose such as holding assets, conducting a specific project, or facilitating financial transactions like securitization or financing arrangements. | A holding company is generally established to hold and manage investments in other companies, subsidiaries, or assets. Its activities are broader and may include investment management, asset protection, and centralized control over subsidiaries. |

| Legal Structure | SPVs are structured to isolate financial risk from the parent company or group. They are often designed to have a simple structure with limited liability. | A holding company has a more complex structure and may have multiple subsidiaries, each with its own legal status and operational activities. |

| Office | Registered Agent’s Office Address | Will need to lease separate physical or virtual office |

| Nexus | Applicants must be able to demonstrate that the SPV will have an appropriate connection or ‘nexus’ to the ADGM, the UAE and/or to the GCC Region (the Nexus Requirement). | No Nexus Requirements |

| Visas | No UAE Resident Visas can be sponsored by the SPV as it is simply a passive entity | Can sponsor a number of UAE Resident Visas based on the size of the premises leased. |

Nominal GDP

GDP per Capita

FDI Inward Stock

UAE | KSA | Antigua | Singapore

© Copyright 2026. All Rights Reserved by Nimbus Consultancy