Saudi Arabia has become a hub for international investment, thanks to its pro-business reforms, and bold Vision 2030 initiative. With the government actively working to promote the growth of non-oil sectors, foreign companies now find it easier to enter the Saudi market.

Central to this effort is the wide array of business licenses made available to non-Saudi investors through the Ministry of Investment of Saudi Arabia (MISA). Understanding the types of licenses in the KSA is critical for ensuring compliance and meeting sector-specific criteria.

This article offers a comprehensive overview of the various Saudi business licenses available in 2025 and how foreign investors can leverage them for strategic entry and business setup in Saudi Arabia.

– Key Types of Licenses in the KSA (2025)

Here are the primary business license categories available to foreign investors as of April 2025, based on MISA’s updated 11th Services Manual.

1. Industrial License

This license applies to entities involved in manufacturing, whether heavy, light, or transformative.

- Allows full foreign ownership

- Requires approval from the Ministry of Industry and Mineral Resources and the National Center for Environmental Compliance

- Requires standard documentation (commercial registration, financials)

- Processed through the MISA E-Services Portal

- Standard turnaround time: 2 to 4 business days

2. Commercial License

This license suits businesses in retail, wholesale, and international trade.

There are two paths under this license:

- 100% Foreign Ownership: Requires a capital of SAR 30 million and operations in at least three countries. Applicants must commit to investing SAR 200–300 million over five years.

- Joint Venture Model: Requires at least 25% Saudi ownership and SAR 26.6 million in capital. It does not require a global presence but does mandate Saudization compliance.

3. Service License

This is one of the most accessible license types for international service providers and is designed for sectors like IT, education, logistics, media, catering, and healthcare.

- Allows 100 percent foreign ownership

- Requires one year of operational history outside Saudi Arabia

- Requires notarized commercial registration and certified financials

4. Entrepreneur License

This license encourages disruptive businesses and facilitates early-stage company formation in Saudi Arabia. It is created for high-growth startups, especially in tech and innovation.

- Requires support from approved entities such as KAUST or the Tourism Development Fund

- Capital assessed case-by-case

- Demonstration of innovation or proprietary IP is mandatory

- Saudi sponsorship is optional for residents

5. Professional License

Targeted at legal, engineering, architecture, and consulting firms.

- Full foreign ownership allowed if operating in four countries and maintaining SAR 10 million per branch

- Joint venture option with at least 25% Saudi ownership also available

- Foreign law firms must obtain Ministry of Justice endorsement

Professional firms should seek assistance from experienced advisory firms in Saudi Arabia to ensure all legal requirements are met.

– Specialized Licenses for Specific Use Cases

Beyond the standard categories, MISA offers specialized licenses for businesses with more specific goals or operational needs. Such licenses are listed below.

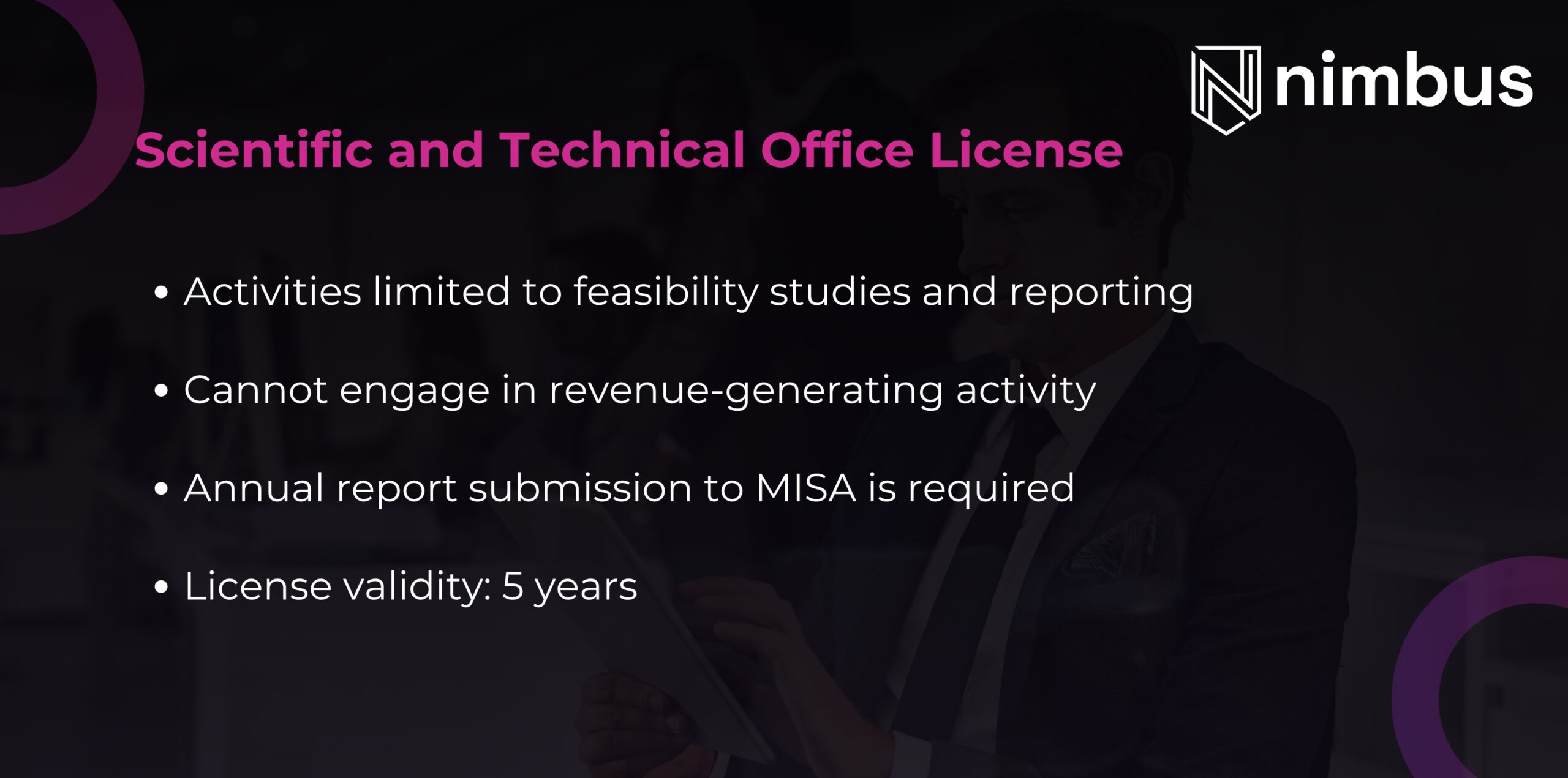

6. Scientific and Technical Office License

This license is intended for foreign firms looking to open liaison offices in the Kingdom. It is ideal for companies conducting research or market analysis before committing to full business setup in the KSA.

- Activities limited to feasibility studies and reporting

- Cannot engage in revenue-generating activity

- Annual report submission to MISA is required

- License validity: 5 years

7. Real Estate License

This license is attractive for firms in hospitality and commercial property development. Foreign property firms can invest in development projects valued at SAR 30 million or more.

- Requires certified financials and attested commercial registration

- GCC partners must provide national ID if not in the ABSHAR system

- Premium residence holders are exempt from certain documentation

8. Regional Headquarters (RHQ) License

This license supports strategic planning and coordination across the MENA region. It is meant to attract multinational companies seeking to centralize their regional operations in Saudi Arabia.

- Requires presence in at least two other countries

- RHQ must be legally registered in the Kingdom

- Cannot engage in commercial sales

- Must employ 15 staff by end of year one, including three senior executives

9. Mining and Agricultural Licenses

These licenses are meant for foreign investors who look forward to work in extractive industries and agricultural development:

- Minimum capital requirement: SAR 25,000

- Follows similar documentation requirements as service and industrial licenses

10. Transport License

A suitable license for experienced logistics companies expanding into the Kingdom. It is segmented into:

- Bus and metro transport

- Taxis and car rentals

- Freight operations

Important requirements include:

- 10–15 years of international experience

- Revenue of SAR 3 billion and assets of SAR 1.5 billion

- Evaluation includes compliance history and operational safety

11. Temporary Licenses

These licenses are ideal for short-term or contract-based foreign involvement in the Kingdom and involve two main types:

- Government Project Proposal License: For companies bidding on public projects, valid for up to one year. Requires ISO certification and revenue history of SAR 500 million.

- Temporary Performance License: Issued for companies executing a specific project contract. Valid only for the project duration.

All licenses must be applied for via MISA’s E-Services Portal. The required documents must be submitted with proper certifications and all fees must be paid within 30 days of invoice issuance, or the application becomes void.

Choosing the Right License

Selecting the correct license is crucial for ensuring regulatory compliance and operational success in Saudi Arabia. Whether you’re entering the market through a joint venture or setting up a regional headquarters, aligning your application with the correct license type can prevent delays and legal issues down the line.

Investors are strongly advised to work with experienced advisory firms offering business setup services in Saudi Arabia. These firms can provide tailored advice, help navigate bureaucratic steps, and ensure a smooth path to company formation in Saudi Arabia.